What is Asset Allocation?

Asset allocation means spreading your investments across various asset classes. Broadly speaking, that means a mix of stocks, bonds, and cash or money market securities.

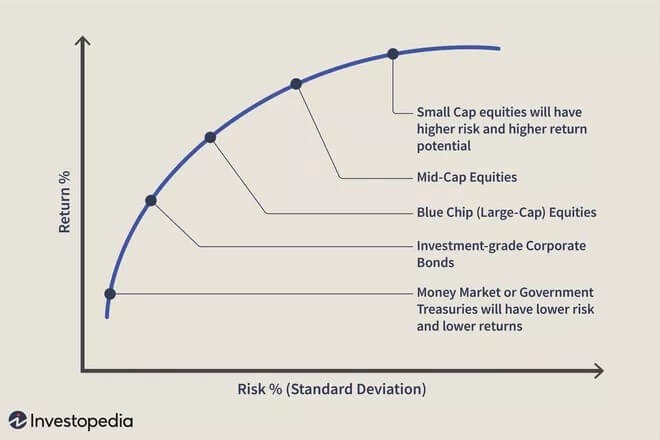

The goal of allocating your assets is to minimize risk while meeting the level of return you expect. To achieve that goal, you need to know the risk-return characteristics of the various asset classes.

The figure below compares the risk and potential return of some of them:

Because each asset class has its own level of return and risk, investors should consider their risk tolerance, investment objectives, time horizon, and available money to invest as the basis for their asset composition. All of this is important as investors look to create their optimal portfolio.

Investors with a long time horizon and larger sums to invest may feel comfortable with high-risk, high-return options. Investors with smaller sums and shorter time spans may prefer low-risk, low-return allocations. The rule of thumb is that an investor should gradually reduce risk exposure over the years in order to reach retirement with a reasonable amount of money stashed in safe investments. This is why diversification through asset allocation is important

To make the asset allocation process easier for clients, many investment companies create a series of model portfolios, each comprised of different proportions of asset classes. Each portfolio satisfies a particular level of investor risk tolerance. In general, these model portfolios range from conservative to very aggressive.

Strategies for Asset Allocation based on Debt/Equity Proportion

| Type of Portfolio | Fixed Income Securities | Equities | Cash & Cash Equivalents |

|---|---|---|---|

| Conservative Portfolio | 60-65% | 25-30% | 5-15% |

| Moderately Conservative Portfolio | 55-60% | 35-40% | 5-10% |

| Moderately Aggressive Portfolio | 35-40% | 50-55% | 5-10% |

| Aggressive Portfolio | 25-30% | 60-65% | 5-10% |

| Very Aggressive Portfolio | 0-10% | 80-100% | 0-10% |

A Conservative Portfolio

The main goal of a conservative portfolio is to protect the principal value of your portfolio. That’s why these models are often referred to as capital preservation portfolios. Even if you are very conservative and are tempted to avoid the stock market entirely, some exposure to stocks can help offset inflation. You can invest the equity portion in high-quality blue-chip companies or an index fund.

A Moderately Conservative Portfolio

A moderately conservative portfolio works for the investor who wishes to preserve most of the portfolio’s total value but is willing to take on some risk for inflation protection. A common strategy within this risk level is called current income. With this strategy, you choose securities that pay a high level of dividends or coupon payments.

A Moderately Aggressive Portfolio

Moderately aggressive model portfolios are often referred to as balanced portfolios because the asset composition is divided almost equally between fixed-income securities and equities. The balance is between growth and income. Because moderately aggressive portfolios have a higher level of risk than conservative portfolios, this strategy is best for investors with a longer time horizon (generally more than five years) and a medium level of risk tolerance.

An Aggressive Portfolio

Aggressive portfolios mainly consist of equities, so their value can fluctuate widely from day to day. If you have an aggressive portfolio, your main goal is to achieve long-term growth of capital. The strategy of an aggressive portfolio is often called a capital growth strategy. To provide diversification, investors with aggressive portfolios usually add some fixed-income securities.

A Very Aggressive Portfolio

Very aggressive portfolios consist almost entirely of stocks. With a very aggressive portfolio, your goal is strong capital growth over a long-time horizon. Because these portfolios carry considerable risk, the value of the portfolio will vary widely in the short term.

Maintaining Your Portfolio

As you decide how to allocate your portfolio, you might choose one of several basic allocation strategies. Each offers a different approach based on the investor’s time frame, goals, and risk tolerance.

When your portfolio is up, it’s important to conduct a periodic review. That includes a consideration of how your life and your financial needs have changed. Consider whether it’s time to change the weighting of your assets.

Even if your priorities haven’t changed, you may find that your portfolio needs to be rebalanced. That is, if a moderately aggressive portfolio racked up a lot of gains from stocks recently, you might move some of that profit into safer money market investments.

The Bottom Line

Asset allocation is a fundamental investing principle that helps investors maximize profits while minimizing risk. The different asset allocation strategies described above cover a wide range of investment styles, accommodating varying risk tolerance, time frames, and goals.

When you’ve chosen an asset allocation strategy that’s right for you, remember to review your portfolio periodically to ensure that you’re maintaining your intended allocation and are still on track for your long-term investment goals.

Concluding View

We apply air bags, disc brakes or EBD to a racer car. These features will enhance the confidence of a driver to drive the car at a high speed but with good confidence to control the car.

In a same way, intention of doing Asset allocation & its periodic review is to minimize the investment portfolio risk. It is never intended to enhance the returns. Investor and advisor must be very clear of its possible outcomes when you opt for Asset allocation strategy.

No Asset allocation strategy can be a winner (best return generator) in all market conditions. It will allow intended risk/return experience during the journey of an investment.

The author is the Director – Of private Wealth at UpperCrust Wealth Pvt. Ltd. With his distinct style and belief in picking. “Return Generating Strategies” which is flexible to suit different market moods and over 25 years of experience in leading investment strategy/research team, establishing effective and well-organized investment processes, quantitative and qualitative portfolio allocation and manage client relationships in financial markets, he has worked with some of the leading names in the financial markets.