Before the origin of Insurtech, the process of buying insurance and claiming settlements was an ordeal in India, and people would online buy when it is utmost necessary. Typically, purchasing insurance in the country required multiple visits to the insurance provider’s office or dealing with sales agents to complete lengthy paperwork and fully understand the details. The terms and conditions were cluttered with jargon, resulting in customers agreeing to buy insurance policies they didn’t need.

As cumbersome as this sounds, the procedure of claiming settlements was worse. In the case of a life insurance claim, one had to visit the specific branch where the policy was issued, submit several documents, and wait for months for the claim to be settled. While the process has become much simpler and faster in metro cities because of digitization, the hustle continues to exist in smaller cities.

Covid has also boosted the sales and importance of having insurance. It has changed the perspective of a lot of people in India about having insurance and this need has been looked by Insurtech and fulfilled with a lot of ease with the help of technology and removed all the hurdles which were there before to get insured. This pool of new people coming to the ecosystem has been captured by Insurtech more than traditional means.

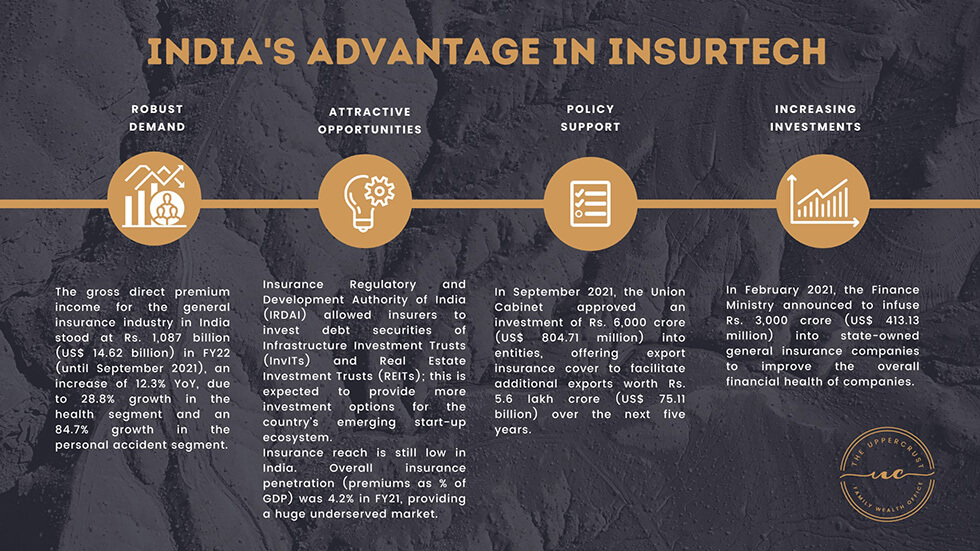

India is the 2nd largest InsurTech market in the APAC region, accounting for 35% of the $3.66 bn capital invested in this region. The online individual insurance market opportunity is estimated to be $1.25 bn by FY25 more than tripling from $365 mn in FY20.

These are the reasons why the majority of India’s 1.38 billion population remains uninsured. In the financial year 2019-20, insurance penetration in India stood at 3.76%, while the global average was 3.35% for life and 3.88% for non-life insurance.

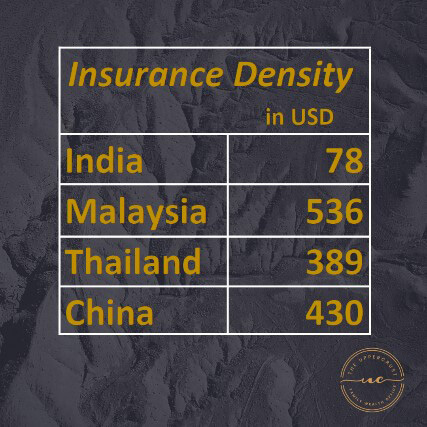

Insurance penetration in some of the emerging economies in Asia, i.e., Malaysia, Thailand and China during the same year were 4.72%, 4.99% and 4.30% percent respectively. The insurance density in India which was USD 11.5 in 2001, reached to USD 78 in 2019 (Life- USD 58 and Non-Life – USD 20).

The life insurance industry booked a weighted new business premium collection of ₹792 billion in the first eight months of FY2019-20, recording year-on-year growth of 64.7%. The life insurance industry in the country is expected to increase by 14-15% annually for the next three to five years.

This puts Insurtech in a unique position to penetrate the Indian market more effectively because of a huge untapped market and penetrate above global average penetration rate.

The future looks promising for the life insurance industry with several changes in the regulatory framework which will lead to further change in the way the industry conducts its business and engages with its customers and the biggest benefactor of this growth is being captured by Insurtech.

Sachin Shah is a guest writer who is an independent researcher and educational blogger.