Buying stock means owning a small stake in the company. An economic moat helps us understand the value of the businesses we invest in. Long-lived companies (companies with strong competitive advantages) are worth more than companies that risk going from hero to zero in a few months because they didn’t have a significant advantage over their competitors. This is the main reason why economic moats are important to investors.

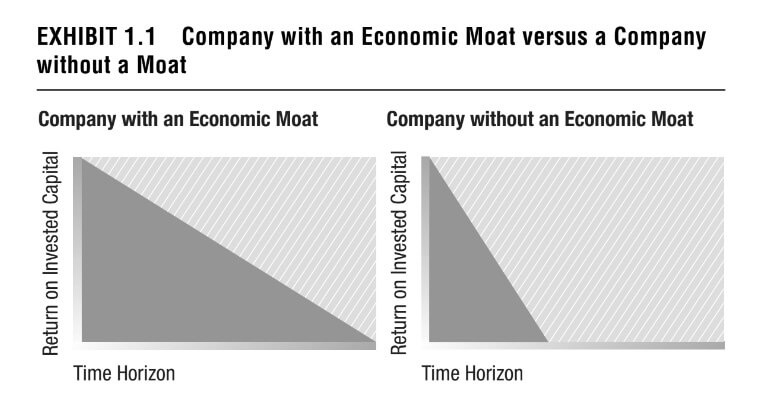

If a company has an economic moat, its cash flows can be reinvested with high returns over the long term. Where there is no moat for a company, the return on investment may decline when competitors enter.

Moated companies are more valuable today because they generate economic returns over the long term. When you buy stock in a company with a moat, you’re buying cash flow that’s protected from competition for years to come. It’s like paying more for a perfect car that will last 10 years than for a cheap car that will wear out in a few years.

A big reason moats are important to investors is because they add value to companies. Identifying moats can help you choose which businesses to buy and what price to pay for them.

In Figure 1.1, the horizontal axis is time and the vertical axis is return on invested capital. You can see that the return on investment for the company on the left (the one with the economic moat) took a long time to decline. This is because the company can keep distance from its competitors i.e. have entry barriers. Companies without the moat on the right face much more intense competition, so their return on investment declines much more quickly. The dark part is the total economic value generated by each company, and you can see how long it is for the company with the moat.

Thinking about moats while investing can protect your investment capital in a number of ways. It enforces investment discipline, making it less likely that you will overpay for a trending hot company with an inconsistent or make-believe competitive advantage. Companies with moats also have greater resilience, they can recover quickly from temporary fall backs. These economic moats can protect companies from competition, helping them earn more money for a long time, and therefore making them more valuable to an investor.