Introduction

Investing is often likened to the world of entertainment, where choices and decisions can yield unpredictable outcomes. Just as Bollywood stars captivate audiences with their performances, investment products capture the attention of investors seeking financial growth. In this intriguing analogy, we’ll explore various investment products by comparing them to Bollywood stars, considering factors such as risk, returns, tenure, and more.

Fixed Deposits – The Amitabh Bachchan of Investments

Much like the evergreen superstar Amitabh Bachchan, fixed deposits are reliable and have stood the test of time. They offer a safe haven for investors with a low-risk appetite. Fixed deposits are known for their stability, providing moderate returns over a fixed tenure. Just as Amitabh Bachchan’s performances continue to be cherished by generations, fixed deposits consistently deliver steady interest income.

Mutual Funds – The Shah Rukh Khan of Investments

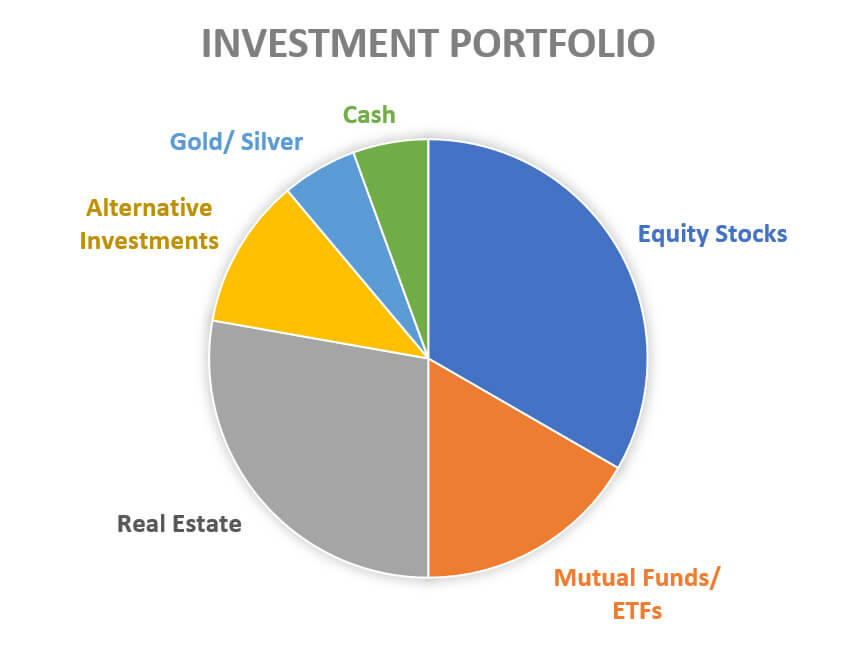

Shah Rukh Khan’s versatility mirrors the diversity of mutual funds. Mutual funds pool money from various investors to invest in a mix of assets like stocks, bonds, and more. Like SRK’s diverse movie roles, mutual funds offer a range of options from equity to debt funds, catering to different risk preferences. The returns and risk associated with mutual funds vary depending on the fund type, akin to SRK’s ability to excel in different genres.

Stocks – The Ranveer Singh of Investments

Ranveer Singh’s energy and charisma can be compared to the dynamism of stock investments. Stocks represent ownership in companies and can be volatile, much like Ranveer’s unpredictable roles. Stock returns can range from spectacular to disappointing, mirroring the highs and lows of the actor’s filmography. Investing in stocks demands research and timing, just as appreciating Ranveer’s performances requires an open mind.

Real Estate – The Aamir Khan of Investments

Aamir Khan’s meticulous approach to roles is akin to the careful consideration required in real estate investments. Real estate offers long-term appreciation potential, reflecting Aamir’s well-thought-out movie choices. However, just as Aamir takes time between films, real estate investments can have a longer holding period. Both demand patience and research, with the promise of substantial returns in the end.

Gold – The Madhuri Dixit of Investments

Madhuri Dixit’s timeless grace is reminiscent of the stability of gold investments. Gold has historically been a store of value, much like Madhuri’s enduring popularity. It serves as a hedge against economic uncertainties, offering a sense of security to investors. Just as Madhuri’s charm transcends generations, gold’s allure remains steadfast in the ever-changing financial landscape.

Cryptocurrencies – The Ranbir Kapoor of Investments

Ranbir Kapoor’s youthfulness aligns with the novelty and risk associated with cryptocurrencies. Cryptocurrencies like Bitcoin and Ethereum have gained attention for their potential high returns but also come with considerable volatility. Just as Ranbir’s roles push boundaries, cryptocurrency investments challenge conventional investment norms, appealing primarily to those comfortable with risk and uncertainty.

Conclusion

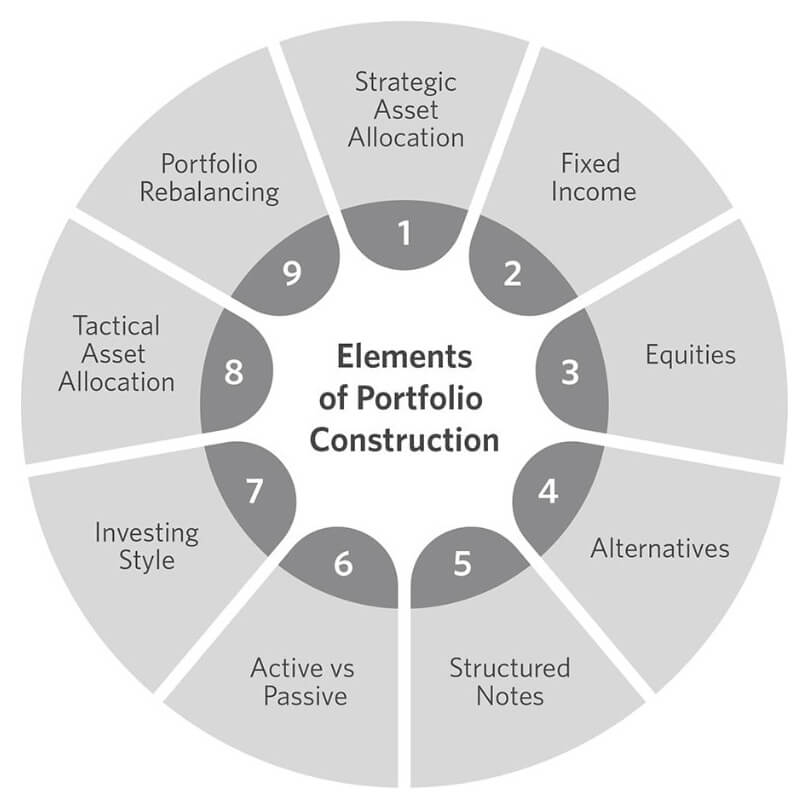

Investing, much like Bollywood, is a realm where diverse options cater to various preferences. Just as Bollywood stars captivate us with their performances, investment products capture our financial aspirations. Understanding the risk, returns, tenure, and characteristics of each investment is vital before stepping onto the stage of financial decision-making. Whether you choose the reliability of fixed deposits, the dynamism of stocks, the versatility of mutual funds, the solidity of real estate, the timelessness of gold, or the innovation of cryptocurrencies, remember that every choice has its own unique appeal, just like our favorite Bollywood stars.