In the fast-paced world of investment, achieving stability can be a daunting task. Markets fluctuate, trends evolve, and economic landscapes shift. In this intricate juggle between risk and reward, stock index balancing emerges as a vital strategy, and MSCI stands as a leading provider of critical decision support tools and services for the global investment community.

Understanding Stock Index Balancing

Stock indices serve as barometers, reflecting the performance of a group of stocks in a specific market or sector. The weightage assigned to each individual stock in an index can significantly impact its overall performance. This is where index balancing applies.

What does MSCI rebalancing mean?

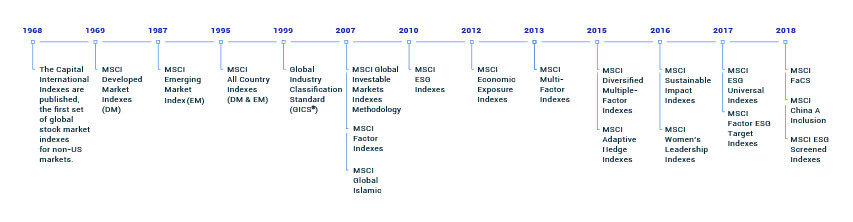

In 1969, Morgan Stanley acquired the licensing rights to publishing the indexes and became the largest shareholder of MSCI Inc.

The rebalancing takes place twice a year for which each index that falls under the MSCI umbrella is reviewed. Accordingly, stocks are added or removed by the MSCI analysts ensuring that every index is an effective equity benchmark for the market it represents. This balance is achieved through a careful allocation of weights to each stock, considering factors like market capitalization, industry representation, and more.

The MSCI Approach

MSCI’s approach to index balancing is a blend of art and science. Their experts employ intricate methodologies to ensure that the index accurately reflects the market’s dynamics while minimizing the risks associated with overconcentration or excessive volatility. MSCI indexing covers both developed and emerging market equities. When the MSCI Index rebalances, funds that track those indices are required to adjust their portfolios based on the latest rebalancing index provided by MSCI. The MSCI reviews all its global and domestic indexes.

The Impact on Investors

For investors, MSCI’s commitment to index balancing translates into a more reliable benchmark for measuring performance and making informed investment decisions. Balanced indices reflect a broader market sentiment, reducing the risks associated with relying solely on a few high-performing stocks.

Takeaways

In the world of investing, achieving stability while capitalizing on growth opportunities is a delicate balance to strike. MSCI’s dedication to stock index balancing showcases its commitment to providing investors with well-rounded, accurate, and representative indices. By understanding the dynamics of these indices, investors can harness the power of diversification and informed decision-making, steering their portfolios toward long-term success.

Leveraging MSCI at UpperCrust Wealth

In an ever-changing world, achieving investment goals such as diversification, uniqueness, or reducing carbon emissions requires accurate data and immediate comprehension. MSCI plays a crucial role in attaining these objectives, making it a popular choice among international institutional investors, fund managers, and research analysts to measure the performance of stock markets.

As a comprehensive source of knowledge for research, collaboration, and technological advancements of listed companies, MSCI acts as my guide for tracking the Indian stock market’s progress. I utilize this index as a benchmark to analyze the performance of mutual funds, ETFs, and other investment vehicles provided by UpperCrust Wealth. This assessment allows me to create and continuously update our clients’ investment portfolios.