I was having a conversation with my friend who recently started working in the industry. After a brief chat, she asked about how to start her financial journey and to manage money so that she has a safe and sound financial future. Even after earning above median income, she doesn’t save or manage her finances well and doesn’t build a good credit score or investments. She inquired about investing in the stock market through SIP and Mutual funds which she was aware of due to financial influencers and didn’t know about other modes of financial planning. After the conversation, I realized how essential it was for our young working generation to learn about personal finance and all the tools which are at their disposal to create secured financial health. Even people who are well-read in the commerce field have little knowledge about new financial tools which came into existence due to the Fintech revolution which has taken place in India. Let me briefly discuss how India is at the forefront of the Fintech revolution.

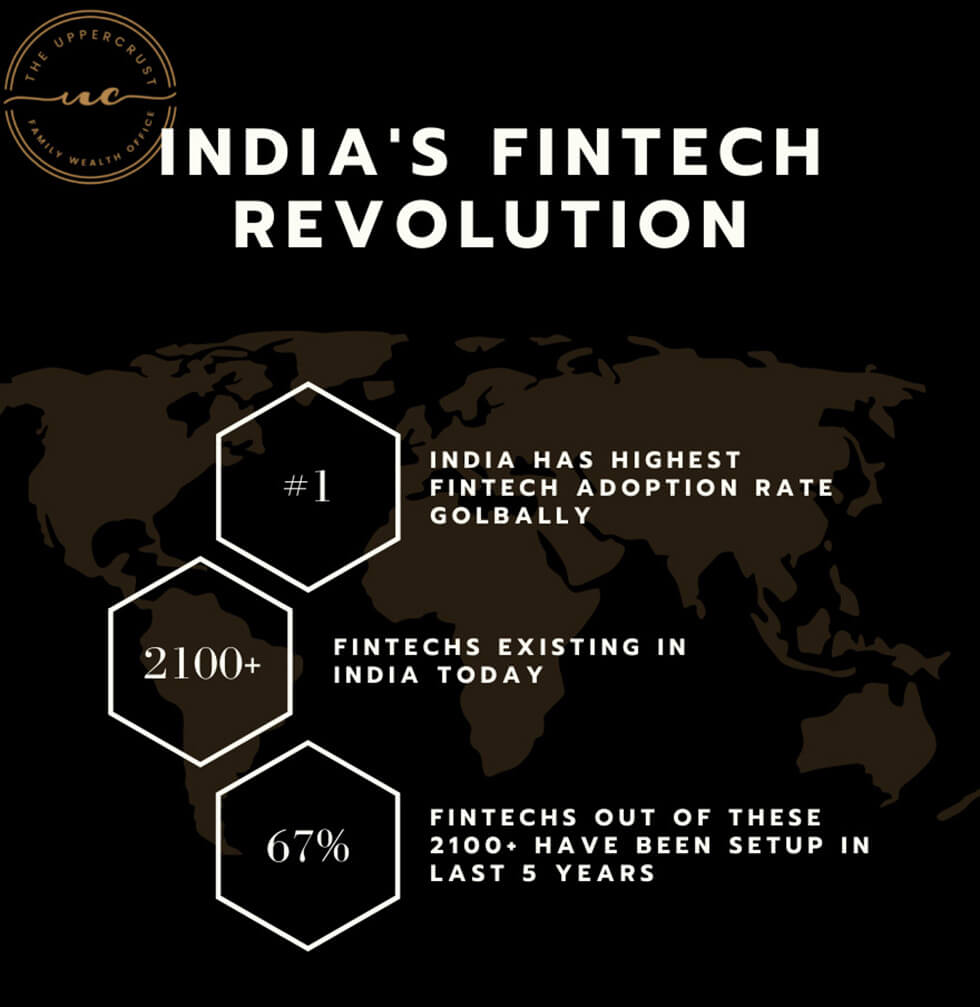

India has the highest Fintech Adoption rate globally of the 2100+ Fintechs existing in India today, over 67% have been set up in the last 5 years.

Indian Fintech Industry was valued at $56-60 Bn in FY20 and is estimated at $150 by 2025. The fintech transaction value size is set to grow from $66Bn in 2019 to $138BN in 2023, at a CAGR of 20%.

The Fintech sector in India has seen cumulative funding of $27 Bn. As of October 2021, India’s Unified Payments Interface(UPI) has seen the participation of 261 banks and has recorded 4.21 Bn monthly transactions worth over $100 Bn on October 21. The fintech sector has 1860 startups. As of December 2021, India has over 17 fintech companies, which gained ‘unicorn status’ with a valuation of over $1Bn. India has seen tremendous growth on the Digital Payments front, clocking a monthly volume of over 5.7 BN transactions worth ~$2 TN (Total Digital Payments) in September’21. India is home to the highest number of real-time online transactions with 25.5 Bn real-time payments transactions in 2020 and is ahead of the US, UK, and China combined. Looking at the current growth and India’s adoption scenario of fintech it will not be an understatement to say that fintech will revolutionize India’s Financial market.

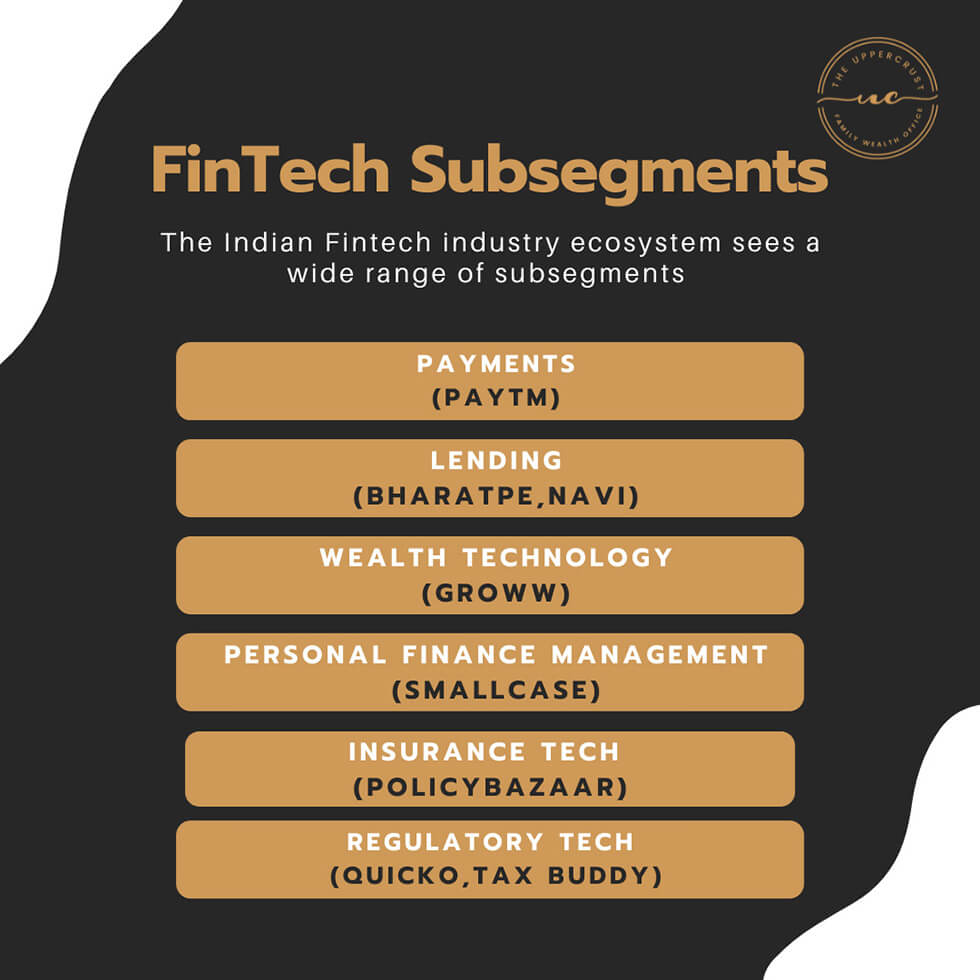

Given there is a revolution taking place in the fintech industry how does it affect you and me in our financial journey? Fintech has given rise to new investment opportunities which have less risk and more return. A lot of new tools give more return than traditional saving tools like Fixed deposits in the given risk involved (eg: P2P lending). There are so many other ways fintech has eased the way of our financial journey.

Sachin Shah is a guest writer who is an independent researcher and educational blogger.