Gone are the days when investors were flooded with liquid cash with no purposeful investment planning in place. However, the advent of various assets classes like ETF, REITs, and AIM offer tremendous opportunities with the best liquidity option, so it is worth investing.

The time has ripe to think outside of the box and act passively – investing through ETFs. The ETFs encapsulate only those indices where they create an opportunistic scenario by incorporating industry or geographic-based portfolios.

How do ETFs act as a catalyst with a variety of mechanisms?

Whether you are a risk-taker or a risk-avert investor, an investment through ETFs is considered to be less risky with the immense diversified opportunity to offer. There are thousands of ETFs available to select from globally. However, it’s the core of the analyst’s job to guide you in terms of selection and engagement with this asset class which has got clamoured from all over the world. An investment in ETFs requires a highly scholastic approach that helps accelerate returns eventually.

As a sophisticated investor, liquidity is your prime concern which is a focused area of ETFs. It’s only the nature of ETFs that ensures multiple layers of liquidity make them a cost-efficient asset to plunge into. We profusely say that ETFs work on the gamut of liquidity and equity that ensures is long-term success.

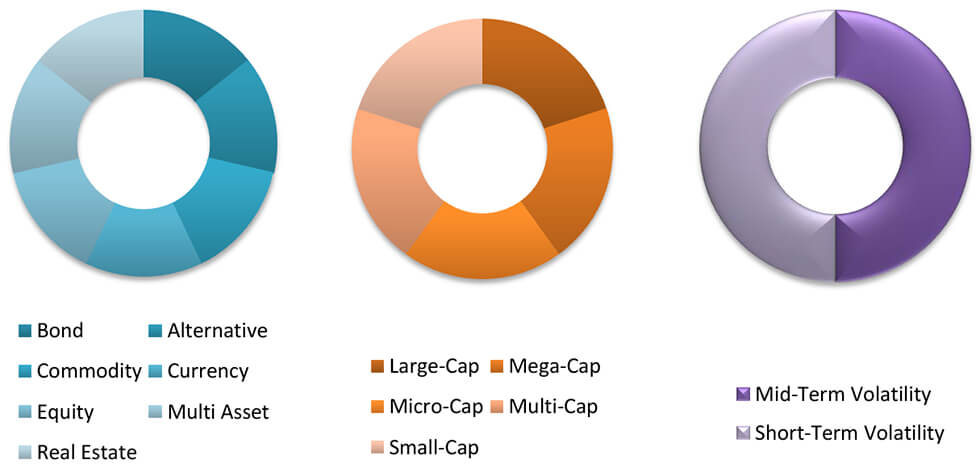

ETFs have been a preferred choice for investment amongst the culture today besides investors’ diversified bucket. An institutional investors’ favoured choice besides stocks, ETFs have come a long way by applying various strategies. The following analytics epitomizes how this asset class works:

With the aforesaid investment strategy in place, ETFs have sprawled their legs globally while becoming a responsible asset class that actively explores and investing the Environmental, Social, and Governance space.

If you consider being a global investor accommodating this asset class, then this is the right time as the prevailing macro fundamentals and strong quarterly results reflect the bright future going forward.

Let your analyst execute the entire exercise from selection to validation to execution of your investment strategy!!!