How Alternative Public Offering works

Besides Mergers & Acquisitions options available to a company, however, a company wants to become public through an APO for several strategic reasons. An “Alternative Public Offering” also said to be a “reverse merger” is a structure by which a private company goes public where a private company merges with a public company that typically has no assets or liabilities.

Transiting Private Companies to go Public through APO

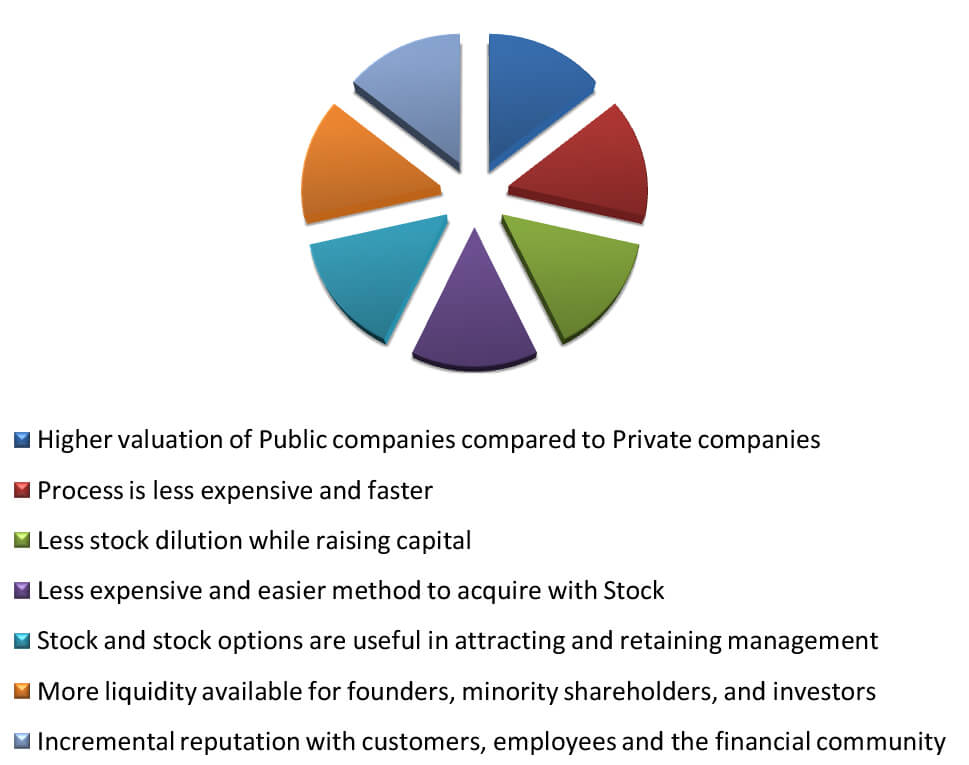

When a company goes public, it transits from being privately held to being publicly held. Companies can go public through an initial public offering (“IPO”) or alternative public offering for various benefits which can be seen from the following analytics:

How a Company stands to gain through Alternative Public Offering than pursuing an IPO

There are numerous advantages associated with APO exercise especially when an inactive IPO market which can be seen from the analytics next page:

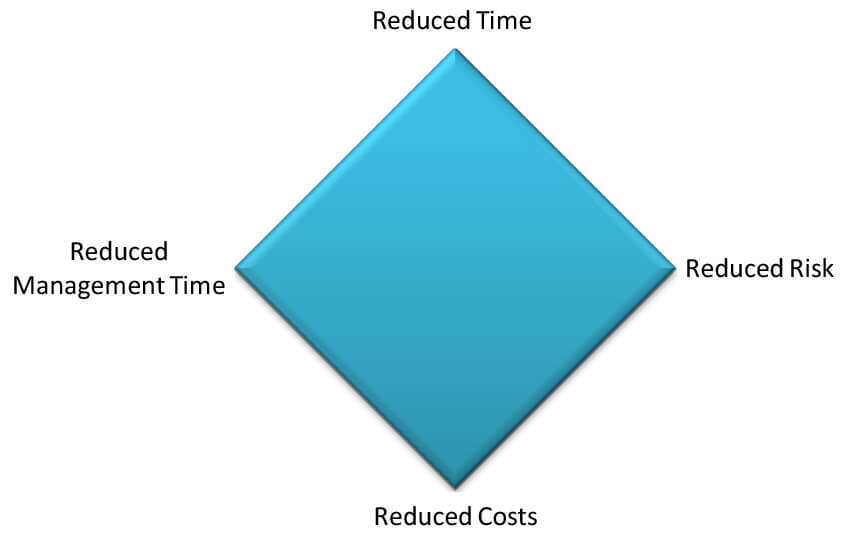

The aforesaid analytics states how an APO can reduce time, risk and cost factors. It helps a company to reduce costs that are higher in case of an IPO. Also, it requires less time frame to secure a public listing than an IPO. The additional risk associated with an IPO is if in case it is withdrawn from the market, the additional upfront fee burden is warded off in the case of APO. The core of the entire exercise is to require great attention from the senior management team.

Why an IPO is not a Viable Option

Sometimes an IPO is not a strategic option as the IPO market is inactive due to major changes in the capital markets and certain macro fundamental changes which create an uncertain market condition for an IPO exercise to succeed. With this, IPO underwriters require much larger deal sizes to maximize their profits mostly fees.

If we recall the past scenario, the average U.S. IPO deal size in 2010 and 2011 was $251 million and $290 million, respectively. On the contrary, the approximate average deal size for a NASDAQ IPO during the 1990s was $35 million. Additionally, there was an average of approximately 35 IPOs raising less than $25 million per year from 1997 through 1999. In contrast, in the 2000s there was an average of fewer than 10 IPOs raising under $25 million per year. As a result of these market conditions, private companies and their investors have been left without a crucial exit strategy, investment research, access to the critical growth capital and other benefits of being public.

Alternative Public Offering offers Strategic options to go Public

In absence of an active IPO market, alternative public offerings have become the new IPO. An alternative public offering comprises two transactions: (1) A Reverse Merger, which is a means for a private company to become publicly traded, and (2) A PIPE financing, which is a private placement into the new public company. APO holds a sophisticated approach where private companies can pursue alternative public offerings independent of underwriters and irrespective of market conditions. As a result, alternative public offerings are a viable option for private companies even when the IPO market is inactive.

How a highly Structured Investment – PIPE works

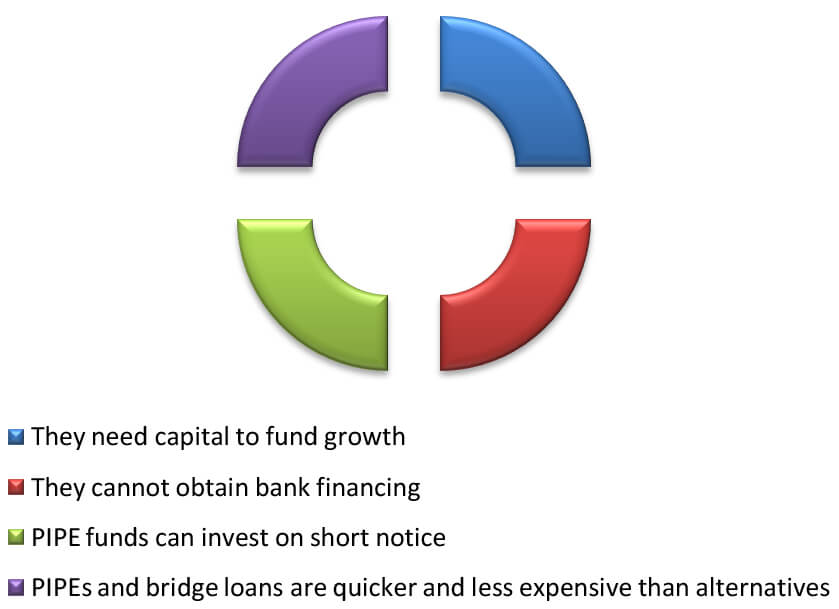

PIPEs negotiate directly with small-cap public companies where the PIPE investors purchase stock or notes at a discount to the market price. There are a variety of benefits for Public companies to pursue PIPE transactions which can be seen from the following analytics:

When we look at the scenario of past decades, PIPEs have become an institutionalized business adopted by the major firms on Wall Street as a flexible financial tool to fund public companies. With recent changes in securities regulations in place, it helps small-cap public companies to pursue PIPE transactions faster thereby increasing the number of PIPE deals.

How to execute Reverse Merger exercise

A reverse merger occurs when a public entity acquires all of the stock of a private company in exchange for a significant majority of the shares of the public entity. The newly merged company takes on the name of the private company, incorporates the private company’s directors and officers, and files with the appropriate regulatory authorities where the merger takes place. This transaction and change of control complete the reverse merger, transforming the formerly private company into a publicly-traded company.

APO acts as a Catalyst for combining both – a Reverse Merger and PIPE

The valuation of a private company increases when it becomes public with this APO exercise. Because as a private entity, it faces many problems while raising capital due to lack of marketability. The APO offers tremendous benefits for the private companies to grow by increasing their size, marketability, and of course greater access to domestic and global investors. After being public, these private companies can raise more capital through a PIPE structure by issuing additional stock in a secondary market.

The following analytics states how the global MNCs have selected to be public even without executing an IPO exercise:

There are ways to grow namely funding to grow organically or funding growth through acquisition. The APO consolidates private companies in this space particularly. The critical part of the entire gamut is to find a public company with no assets and liability with the thorough due diligence required to be in place!